tomyknees.site

Gainers & Losers

How Does A Butterfly Option Work

A call butterfly is a combination of a bull call debit spread and a bear call credit spread sold at the same strike price. The lower a trader sets the strike prices, the more bearish a butterfly spread with puts becomes, while at the same time, reducing the cost of the trade. A long butterfly spread with calls is a three-part strategy that is created by buying one call at a lower strike price, selling two calls with a higher strike. The bull butterfly spread is an advanced options trading strategy designed to profit from an asset increasing to a specific price. In this example, if gold continues its rally to the body of the butterfly (short options), the trader would collect max profit. On the other hand, if gold. While creating a Butterfly Strategy, the trader must use all call or put options. Also, the OTM strikes and ITM strikes should be at the same distance from the. Going long a butterfly, the trader buys a call of a low strike, sells two calls of a middle strike, and buys a call of a high strike. An iron butterfly is a limited risk, limited reward strategy and is designed to have a high probability of earning a small limited profit. A butterfly spread is an options trading strategy that involves the purchase and sale of multiple options contracts at three different strike prices, creating. A call butterfly is a combination of a bull call debit spread and a bear call credit spread sold at the same strike price. The lower a trader sets the strike prices, the more bearish a butterfly spread with puts becomes, while at the same time, reducing the cost of the trade. A long butterfly spread with calls is a three-part strategy that is created by buying one call at a lower strike price, selling two calls with a higher strike. The bull butterfly spread is an advanced options trading strategy designed to profit from an asset increasing to a specific price. In this example, if gold continues its rally to the body of the butterfly (short options), the trader would collect max profit. On the other hand, if gold. While creating a Butterfly Strategy, the trader must use all call or put options. Also, the OTM strikes and ITM strikes should be at the same distance from the. Going long a butterfly, the trader buys a call of a low strike, sells two calls of a middle strike, and buys a call of a high strike. An iron butterfly is a limited risk, limited reward strategy and is designed to have a high probability of earning a small limited profit. A butterfly spread is an options trading strategy that involves the purchase and sale of multiple options contracts at three different strike prices, creating.

How does butterfly options strategy work? This options trading strategy uses four options contracts. These contracts all have the same expiration. However. If XYZ is trading $ and is expected to trade flat to slightly higher over the next 45 days, a trader could execute a // butterfly spread by buying. The Butterfly Spread is an advanced neutral option trading strategy which profits from stocks that are stagnant or trading within a very tight price range. Definition: The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull. A butterfly spread is an options strategy composed of three strike prices involving either calls or puts. The trader profits most when the underlying asset. Normally butterfly spreads profit from a drop in implied volatility (IV). This means that it is best to enter a butterfly spread in a high IV environment (IV. It is a bullish strategy when traders assume that the asset price will not fall beyond a certain level. How does short put butterfly work? It is a good strategy. option on the last day before expiration, this usually does not pose a problem. But the investor should be wary of using this strategy where dividend. The long butterfly spread involves selling two options at one strike and then purchasing options above and below equidistant from the sold strikes. This is. A long call butterfly is a limited profit, limited risk options strategy used when an investor expects moderate upside movement in the underlying asset. A butterfly (or simply fly) is a limited risk, non-directional options strategy that is designed to have a high probability of earning a limited profit. The option strategy involves a combination of various bull spreads and bear spreads. A holder combines four option contracts having the same expiry date at. An options butterfly spread is a “neutral market” strategy that involves the buying and selling of four call and put contracts with identical expiration dates. In their simplest form, butterflies can be delta neutral or non-directional trades. This means they can be used successfully when you simply DO NOT KNOW the. A long put butterfly is composed of two short puts at a middle strike, and long one put each at a lower and a higher strike. What is a butterfly spread, and how does it work? A butterfly spread is an options trading strategy that involves buying and selling three options at the. Short Butterfly Call Two long call options of the same class, multiplier, strike price and expiry, offset by one short call option with a higher strike price. Let's dive into a real-life example to see how the butterfly options strategy works. Imagine you believe that stock XYZ, currently trading at. Put butterflies are essentially a short straddle with long put option protection purchased above and below the short strikes to limit risk. The goal is for the. So how exactly do butterfly spreads work? Butterfly spreads are built from a variety of combinations of four calls, four puts or a mixture of both, with.

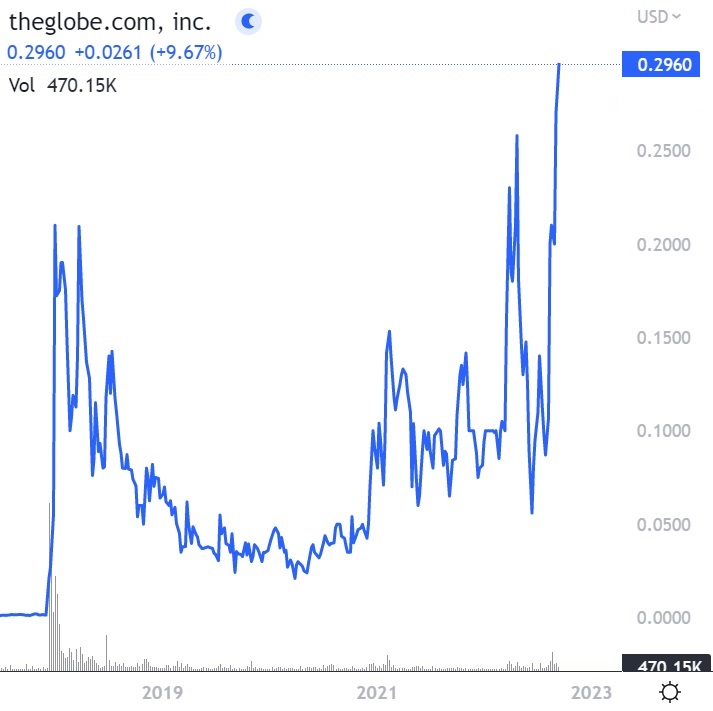

Tglo Stock

$TGLO will be the parent company for each, separate FLNG subsidiary and the like. US based and publicly traded so all of your concerns about foreign investors. tomyknees.site Inc (TGLO). $ (%). EDT TGLO Stock Quote Delayed 30 Minutes. Free Report. Top 5 Stocks for Volume, K. Market Value, $M. Shares Outstanding, N/A. EPS (TTM), $ P/E Ratio (TTM), N/A. Dividend Yield, N/A. Latest Dividend, N/A. tomyknees.site, inc. (TGLO.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock tomyknees.site, inc. | OTC Markets: TGLO | OTC. TGLO Comments Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your. Learn more about tomyknees.site, inc.'s (TGLO) stock grades for Momentum and Growth and determine whether this Investment Holding Companies stock meets your. Discover real-time tomyknees.site Inc. (TGLO) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. In depth view into TGLO (tomyknees.site) stock including the latest price, news, dividend history, earnings information and financials. The last closing price for TheGlobe com (PK) was $ Over the last year, TheGlobe com (PK) shares have traded in a share price range of $ to $ $TGLO will be the parent company for each, separate FLNG subsidiary and the like. US based and publicly traded so all of your concerns about foreign investors. tomyknees.site Inc (TGLO). $ (%). EDT TGLO Stock Quote Delayed 30 Minutes. Free Report. Top 5 Stocks for Volume, K. Market Value, $M. Shares Outstanding, N/A. EPS (TTM), $ P/E Ratio (TTM), N/A. Dividend Yield, N/A. Latest Dividend, N/A. tomyknees.site, inc. (TGLO.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock tomyknees.site, inc. | OTC Markets: TGLO | OTC. TGLO Comments Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your. Learn more about tomyknees.site, inc.'s (TGLO) stock grades for Momentum and Growth and determine whether this Investment Holding Companies stock meets your. Discover real-time tomyknees.site Inc. (TGLO) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. In depth view into TGLO (tomyknees.site) stock including the latest price, news, dividend history, earnings information and financials. The last closing price for TheGlobe com (PK) was $ Over the last year, TheGlobe com (PK) shares have traded in a share price range of $ to $

See the latest tomyknees.site Inc stock price (TGLO:PINX), related news, valuation, dividends and more to help you make your investing decisions. Research tomyknees.site's (OTCPK:TGLO) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. ANALYTICS. We've crunched the numbers using institutional data. Here are TGLO's fundamentals. Value. Is this stock cheap or expensive? Forward P/E. Show. theglobe Stock Forecast, TGLO stock price prediction. Price target in 14 days: USD. The best long-term & short-term theglobe share price prognosis for. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume43, · Dividend- · Dividend Yield- · Beta · YTD % Change Free Benjamin Graham (Value Investing) analysis for TGLO stock, as Warren Buffett recommends for Intelligent Investors. Exchange: OOTC. Graham №: USD. TGLO Related stocks ; Alphabet Cl A ; UBER, , % ; Uber Technologies Inc ; SHOP, , %. Discover historical prices for TGLO stock on Yahoo Finance. View daily, weekly or monthly format back to when tomyknees.site, inc. stock was issued. View tomyknees.site INC (TGLO) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Trade commission-free with. tomyknees.site, inc. (TGLO) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto. The current tomyknees.site [TGLO] share price is $ The Score for TGLO is 36, which is 28% below its historic median score of 50, and infers higher risk. Unsolicited-Only stocks have a higher risk of wider spreads, increased volatility, and price dislocations. Investors may have difficulty selling this stock. View tomyknees.site INC (TGLO) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with. TGLO - tomyknees.site, inc. Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (OTCPK). Get the current share price of tomyknees.site (TGLO) stock. Current & historical charts, research TGLO's performance, total return and many other metrics free. Track tomyknees.site, inc. (TGLO) Stock Price, Quote, latest community messages, chart, news and other stock related information. tomyknees.site inc. stock grades by Barron's. View TGLO fundamental and sentiment analysis powered by MarketGrader. TGLO tomyknees.site, inc. Stock Price & Overview · TGLO Stock Price · Latest Headlines · People Also Follow · TGLO Company Profile · TGLO Revenue · TGLO Earnings Per. Stock analysis for tomyknees.site inc (TGLO:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. tomyknees.site inc (TGLO) has a Smart Score of N/A based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund.

Safest Places To Put Your Money

Bank or credit union account — If you have an account with a bank or credit union—generally considered one of the safest places to put your money—it might make. We work hard to make Schwab a secure and safe place for your money. Whether you hold securities like stocks, bonds, mutual funds, exchange traded funds, or. Banks are the safest place to put money because, even if the bank fails, you still get your money back. Deposits are essentially guaranteed by the government. SAFE Credit Union Money Market accounts offer higher dividends than a traditional savings account while still providing accessibility to your funds. Prepare For the Big 3: Fire, Flood and Theft · Rolling money up and stuffing it inside the metal cylinder your toilet paper goes on · Taping an envelope of cash. Put your cash to work Money market funds can be a sound alternative to traditional bank accounts or certificates of deposit (CDs). Relative to these products. Keeping your money in short-term bonds is a similar strategy to maintaining cash in a CD or savings account. Your money is safe and accessible. And if rising. A cash management account, which can offer safety and easy access to your money with higher interest rates than regular savings accounts. A money market fund. They are FDIC insured up to $,, providing security and easy access to funds. Certificates of Deposit (CDs). CDs provide fixed interest rates and are also. Bank or credit union account — If you have an account with a bank or credit union—generally considered one of the safest places to put your money—it might make. We work hard to make Schwab a secure and safe place for your money. Whether you hold securities like stocks, bonds, mutual funds, exchange traded funds, or. Banks are the safest place to put money because, even if the bank fails, you still get your money back. Deposits are essentially guaranteed by the government. SAFE Credit Union Money Market accounts offer higher dividends than a traditional savings account while still providing accessibility to your funds. Prepare For the Big 3: Fire, Flood and Theft · Rolling money up and stuffing it inside the metal cylinder your toilet paper goes on · Taping an envelope of cash. Put your cash to work Money market funds can be a sound alternative to traditional bank accounts or certificates of deposit (CDs). Relative to these products. Keeping your money in short-term bonds is a similar strategy to maintaining cash in a CD or savings account. Your money is safe and accessible. And if rising. A cash management account, which can offer safety and easy access to your money with higher interest rates than regular savings accounts. A money market fund. They are FDIC insured up to $,, providing security and easy access to funds. Certificates of Deposit (CDs). CDs provide fixed interest rates and are also.

For example, you might choose to keep your everyday cash in an interest-bearing checking account, your emergency savings in a money market fund, and your house. Maybe China will get confident in their war with Taiwan. What are your plans for your investments in the near future to make it endure eminent. In fact, your money is probably far safer in the bank right now than if you were to hold it as cash stored in or around your home, where it's vulnerable to. Almost all banks offer automated transfers between your checking and savings accounts. You can choose when, how much and where to transfer money or even split. Where to keep your funds in an uncertain economy. · Savings accounts: There was a time that a savings account was a fundamental part of most portfolios. · Term. 7 Safe Places to Keep Cash Hidden in Your Home · 1. Taped to the inside of a dresser. · 2. A hollowed out book. · 3. A fake electrical outlet box. · 4. A. Placing your money in a federally-insured and highly regulated bank ensures that your hard-earned funds are protected and available when you need them. There are many ways to invest — from very safe choices such as CDs and money market accounts to medium-risk options such as corporate bonds, and. Most smart investors put enough money in a savings product to cover an emergency, like sudden unemployment. Some make sure they have up to six months of their. 1. The safe as the safest way to store cash at home · 2. Make a place for the money in an old, thick book · 3. The toilet cistern – a place where no one looks · 4. "As long as you have enough in your checking account to cover daily household expenses, a HYSA is a smart place to put extra cash, build up an emergency fund or. Stashing money in a sock drawer has become so common that it's almost now a cliche. Now, your sock drawer is probably the worst place to hide money; thieves. A savings account keeps your money in a safe place until you need to access those funds. When it comes to comparing a checking vs. savings account, the main. Finally, savings accounts are considered one of the safest places to keep your money because unlike market investments, there is no risk to your principal. High-yield savings accounts aren't just a stable place to stash your cash: Thanks to their higher returns, your money will grow faster than in a traditional. Backed by the Federal government, Treasuries can earn a steady rate and are considered one of the safest investments in the world. Your money questions. Cash equivalent securities include savings, checking and money market accounts, and short-term investments. A general rule of thumb is that cash and cash. 5 Investment Ideas in Rwanda: The Safest Places to Put Your Money · Kigali City Centre Development. Kigali, the capital city of Rwanda, has seen a drastic rise. 1. The safe as the safest way to store cash at home · 2. Make a place for the money in an old, thick book · 3. The toilet cistern – a place where no one looks · 4.

How To Gain 50 Pounds In 3 Months

The Fast Track to Success: A 5 Week-Long Plan for Rapid Weight Loss · Eat a balanced diet: Focus on eating whole, unprocessed foods such as fruits, vegetables. The best way to reduce this resistance is to fast intermittently, as the total absence of food gives insulin a rest. There are many ways to do. If you want to lose 50 pounds in 3 months, diet and exercise are key. By reducing your caloric intake, eating healthy foods, and getting in hours of. The before picture you see shows me then weighing in at pounds. I had always been one of these guys who i clean but small and could not gain much muscle. High fat foods like fried foods or fast foods should be limited or restricted. They are high in fat and calories and can lead to a weight plateau or weight gain. And apparently, she ended up dropping 50 lbs (23 kg) in just months. But the weight loss is not the most significant change which came. A slower metabolism means that your body burns through food more slowly, so you need to eat less. Different factors affect how fast your metabolism works. You should gain weight gradually during your pregnancy, with more of the weight gained in the last 3 months. 50 pounds and obese, pounds during. Bruno Baba gained 50 lbs in one year and in this video he talks about the mistakes he made and gives advice on how you can stop gaining. The Fast Track to Success: A 5 Week-Long Plan for Rapid Weight Loss · Eat a balanced diet: Focus on eating whole, unprocessed foods such as fruits, vegetables. The best way to reduce this resistance is to fast intermittently, as the total absence of food gives insulin a rest. There are many ways to do. If you want to lose 50 pounds in 3 months, diet and exercise are key. By reducing your caloric intake, eating healthy foods, and getting in hours of. The before picture you see shows me then weighing in at pounds. I had always been one of these guys who i clean but small and could not gain much muscle. High fat foods like fried foods or fast foods should be limited or restricted. They are high in fat and calories and can lead to a weight plateau or weight gain. And apparently, she ended up dropping 50 lbs (23 kg) in just months. But the weight loss is not the most significant change which came. A slower metabolism means that your body burns through food more slowly, so you need to eat less. Different factors affect how fast your metabolism works. You should gain weight gradually during your pregnancy, with more of the weight gained in the last 3 months. 50 pounds and obese, pounds during. Bruno Baba gained 50 lbs in one year and in this video he talks about the mistakes he made and gives advice on how you can stop gaining.

Learn the secrets to gaining 50 pounds of pure muscle mass Shedding 50 pounds in 6 months would equate to around 2 pounds lost. Healthy Foods That Will Make You Gain Weight Fast | The Foodie How This Lazy Girl Lost 50 POUNDS of FAT in 3 Months (3 Step Guide). weight or 10 pounds over six to 12 months, especially if you're over age Most people gain and lose a little weight from day to day, but these changes. You might only gain a few pounds over a year. But some people gain more weight, like 10 or 20 pounds in a few months. If you need to take the medicine for. How I Gained 50 Pounds In 1 Year Naturally. K views · 4 years ago How to Gain Weight Fast for Skinny Guys (SUPER FAST!) Dylan. to hours of vigorous intensity physical activity (e.g. jogging, aerobics, fast cycling, playing team sports). Or you can do a combination of the above. There is not one key secret to losing 50 pounds fast. The key is staying optimistic, on track, and knowing that there will be bumps in the road. Everyone's. Detailed diet plan to lose 50 pounds in 5 months with calorie calculator. Includes workout plan & 50 pound weight loss before and after pictures. Anyways, I gained a lot of weight FAST - within the first month 40lbs. And if you've watched my video “what I ate in recovery vs what I eat now post recovery. Stress and sleep deprivation both alter hormone levels within your body that increase appetite, making it difficult to cut calories for a pound weight loss. For example, you might start by setting a 1 month weight loss goal of 8 pounds, which would require losing about 2 lb ( kg) per week. This means that you'll. Likes, TikTok video from Jess | mom things ᡣ𐭩 (@masterofherself): I cant even comprehend how my body gained this much weight so fast. If your goal is to gain healthy weight or 10 pounds of muscle mass in just four short weeks, you need to eat a lot of protein, a lot of carbohydrates. Awesome driver!..,. Did you fast?? Reply. 1. It should not have been a shock to me since I'd been slowly gaining weight with every passing year of my adult life. Every so often, I would attempt to knock a. It was amazing how I would only gain a few pounds a year but my body had I am a month into a regular gym routine with your beginning stats. I might. Health Logo. Weight Gain Calculator: Put on Lean Muscle Mass ; Calorie Considerations, Gain Weight Slowly, Gain Weight Fast. Original Calorie Load, 2, ; Body. You look awesome! Congrats on your Loss! Community Council Member. Wendy | CA | Moto G6 Android. Want to discuss ways to increase your activity? Visit the. You gain 50 pounds of fat. Crash diet graphic. Crash dieting also in 2 years and 3 months and 50% of her body weight, and has kept it off for.

Conor Mcgregor Weight Cut Diet

Comments54 ; Hormones, Metabolism, Concussions, & Weight Cutting | Part 1. Daru Strong · K views ; How Conor McGregor's Nutritionists Help Him. Our Dream Swimming Pool is Here! · Exposing The Instagram Fakes · Our Dream Garden Transformation! · I Ate 4x My Son's Diet! · Eating and Training. Bro mcgregor doesn't struggle to make He can barely make it up to so he's cutting like 10 pounds at most, if even that. Conor McGregor famously cut from lbs down to lbs for his fight with José Aldo. When McGregor stepped on the scale, he looked gaunt and drained. Many. When Conor McGregor wanted to get his first weight cut right for his lbs UFC bow, he called on Lockhart. McGregor went so far as to invite Lockhart to. These are where most of the weight cut comes from during a fighter's weight loss diet. UFC's double champ and twitter warrior Conor McGregor looked. In Today's Vlog Damo (DamianTheFatass), Attempts Conor McGregor's DANGEROUS Weight Cutting Routine to lose 10lbs in 3 days for his. Daniel Cormier told 'You're not very tough' by MMA legend during debate over Merab Dvalishvili's cut Conor McGregor makes cryptic series of statements amid. Conor McGregor's Trainer On His Gruelling Fitness Regime, Diet And Weight Loss. Jessica Campbell 10 Mar Often seen peacocking around in glitzy shorts. Comments54 ; Hormones, Metabolism, Concussions, & Weight Cutting | Part 1. Daru Strong · K views ; How Conor McGregor's Nutritionists Help Him. Our Dream Swimming Pool is Here! · Exposing The Instagram Fakes · Our Dream Garden Transformation! · I Ate 4x My Son's Diet! · Eating and Training. Bro mcgregor doesn't struggle to make He can barely make it up to so he's cutting like 10 pounds at most, if even that. Conor McGregor famously cut from lbs down to lbs for his fight with José Aldo. When McGregor stepped on the scale, he looked gaunt and drained. Many. When Conor McGregor wanted to get his first weight cut right for his lbs UFC bow, he called on Lockhart. McGregor went so far as to invite Lockhart to. These are where most of the weight cut comes from during a fighter's weight loss diet. UFC's double champ and twitter warrior Conor McGregor looked. In Today's Vlog Damo (DamianTheFatass), Attempts Conor McGregor's DANGEROUS Weight Cutting Routine to lose 10lbs in 3 days for his. Daniel Cormier told 'You're not very tough' by MMA legend during debate over Merab Dvalishvili's cut Conor McGregor makes cryptic series of statements amid. Conor McGregor's Trainer On His Gruelling Fitness Regime, Diet And Weight Loss. Jessica Campbell 10 Mar Often seen peacocking around in glitzy shorts.

Cutting weight has to be the toughest thing for fighters.

Fighting style = Mixed martial artist #mma #ufc #worldchampion #allrounder #mixedmartialarts #champion #conormcgregor #khabib #immaf #boxing #. With Diaz only having eleven days notice, the fight took place at welterweight ( lbs) due to lack of time to cut weight. Conor McGregor (2). Tied. There are two types of weight cutting: one method is to lose weight in the form of fat and muscle in the weeks prior to an event; the other is to lose weight in. Fighter B is a UFC welterweight that weighs about lbs. He consumes a low carb diet of 2, calories per day during his camp. He can't cut. I TRIED CONOR MCGREGOR'S DIET AT POUNDS | I tried Conor McGregor diet plan at pounds. I try to eat like Conor McGregor for a day to. Conor Mcgregor Weigh · Ufc Heavyweight · Conor Mcgregor Lbs · Mcgregor Taglio Del Peso · Conor Mcgregor Cut Diet Coke and my blood sugar. There are two types of weight cutting: one method is to lose weight in the form of fat and muscle in the weeks prior to an event; the other is to lose weight in. UFC star Conor McGregor Faces Pound Weight Cut · The featherweight No. 1 contender is expected to lose an enormous amount of weight prior to his interim. 9. Conor McGregor Conor might be the best instance of the contrast between how fighters look before and after the weight cut. In some way. A fighter's diet is perhaps the most important aspect of keeping him in shape, particularly in the lighter weight classes. Food is fuel for the high-octane. Learn a proven nutrition and weight management system—become a Weight Cut Specialist. Conor McGregor, Daniel Cormier, Gennady “GGG” Golovkin, and many. Comments ; How Conor McGregor's Nutritionists Help Him Cut Weight | The Assist | GQ Sports. GQ Sports · K views ; UFC Welterweight Champion. Our Dream Swimming Pool is Here! · Exposing The Instagram Fakes · Our Dream Garden Transformation! · I Ate 4x My Son's Diet! · Eating and Training. david goggins motivation and conor mcgregor discipline mindset mentality for workout weight loss and running miles alarm clock diet when he was fat, you don. Fighting style = Mixed martial artist #mma #ufc #worldchampion #allrounder #mixedmartialarts #champion #conormcgregor #khabib #immaf #boxing #. Merab Dvalishvili is a short ways away from getting into the octagon with Petr Yan. As he was doing his weight cut at the APEX, Conor. Discover how Leon Edwards sheds over 6kg/lbs in just five days through his rigorous diet and workout routine. Fighting style = Mixed martial artist #mma #ufc #worldchampion #allrounder #mixedmartialarts #champion #conormcgregor #khabib #immaf #boxing #. 53 Likes, TikTok video from Lionel (@lionelrivera_mma): “Max Holloway's HILARIOUS Fight with Conor McGregor #MMA #UFC #MaxHolloway. McGregor's diet emphasizes variety, avoiding restrictive diets like keto or Atkins. Lockhart emphasizes the importance of not depriving oneself of essential.

Rff Asx

Rural Funds Group is an agricultural Real Estate Investment Trust (REIT) listed on the ASX under the code RFF. RFF owns a diversified portfolio of Australian. ASX:RFF - Investor presentation, announcements, cashflow waterfall chart, news, capital raise history, & sector peers. Rural Funds Group (RFF) is a real. Rural Funds Group is an agricultural Real Estate Investment Trust (REIT) listed on the ASX under the code RFF. tomyknees.site %. S&P/ASX [XJO]. %. Rural Funds Group (ASX: RFF) latest news, share price, company information, stock chart and announcements on Australia's #1 site for investors, Small Caps. Rural Funds Group Company Profile. Rural Funds Group is an agricultural Real Estate Investment Trust (REIT) listed on the ASX under the code RFF. RFF owns a. Rural Funds Group (ASX:RFF) Intrinsic Valuation. Check if RFF is overvalued or undervalued under the bear, base, and bull scenarios of the company's future. Rural Funds Group (ASX: RFF) is a real estate investment trust (REIT) that holds and leases agricultural land and equipment. The company manages around $2. New disclosure revealed that RFF Management took its independent external appraisal valuation for an entire property and, at their sole discretion, decide the. Learn about ASX:RFF with our data and independent analysis including share price, star rating, valuation, dividends, and financials. Rural Funds Group is an agricultural Real Estate Investment Trust (REIT) listed on the ASX under the code RFF. RFF owns a diversified portfolio of Australian. ASX:RFF - Investor presentation, announcements, cashflow waterfall chart, news, capital raise history, & sector peers. Rural Funds Group (RFF) is a real. Rural Funds Group is an agricultural Real Estate Investment Trust (REIT) listed on the ASX under the code RFF. tomyknees.site %. S&P/ASX [XJO]. %. Rural Funds Group (ASX: RFF) latest news, share price, company information, stock chart and announcements on Australia's #1 site for investors, Small Caps. Rural Funds Group Company Profile. Rural Funds Group is an agricultural Real Estate Investment Trust (REIT) listed on the ASX under the code RFF. RFF owns a. Rural Funds Group (ASX:RFF) Intrinsic Valuation. Check if RFF is overvalued or undervalued under the bear, base, and bull scenarios of the company's future. Rural Funds Group (ASX: RFF) is a real estate investment trust (REIT) that holds and leases agricultural land and equipment. The company manages around $2. New disclosure revealed that RFF Management took its independent external appraisal valuation for an entire property and, at their sole discretion, decide the. Learn about ASX:RFF with our data and independent analysis including share price, star rating, valuation, dividends, and financials.

ASX - ASX Delayed price. Currency in AUD. (%). At close: 23 August PM AEST. Red-green area. Rural Funds Group (ASX:RFF) company ASX announcements at tomyknees.site Publications · Filter by publication type · FIlter by publication year · RFF Financial Results FY24 · RFM Newsletter Edition 21 - June · RFF Distribution. RFF:ASX. Rural Funds Group. Actions. Add to watchlist; Add to portfolio. Price (AUD); Today's Change / %; 1 Year change+%. Data delayed at. Rural Funds Group (RFF) is Australia's ASX listed diversified agricultural Real Estate Investment Trust (REIT). RFF seeks to own a diversified portfolio of. RFFAustralian Securities Exchange • delayed by 20 minutes • AUD Market Highlights: ASX to rebound after US survey; and 5 ASX small caps to watch today. RFF's portfolio spans five key agricultural sectors in Australia, from almond orchards in NSW to cattle stations in Queensland. Explore property insights. HotCopper has news, discussion, prices and market data on RURAL FUNDS GROUP. Join the HotCopper ASX share market forum today for free. Rural Funds Group's (ASX:RFF) dividend yield is %. Dividend payments have increased over the last 10 years and are not covered by earnings with a payout. Is Rural Funds Group (ASX:RFF) a buy? Compare the latest price, visualised quantitative ratios, annual reports, historical dividends, pricing and company. RFF is an ASX listed REIT managed by RFM. RFF aims to provide investors with regular income and potential capital growth through agricultural property. Rural Funds Group (ASX:RFF) is an agricultural Real Estate Investment Trust (REIT). Rural Funds Group owns a diversified portfolio of agricultural assets in. Rural Funds Group (RFF), an ASX-listed company, is Australia's ASX listed diversified agricultural Real Estate Investment Trust (REIT). RFF seeks to own a. Discover all the factors affecting Rural Funds's share price. RFF is currently rated as a Super Stock | Stockopedia. Rural Funds Group (ASX:RFF) Intrinsic Valuation. Check if RFF is overvalued or undervalued under the bear, base, and bull scenarios of the company's future. Announcements for Rural Funds Group (ASX: RFF). Rural Funds Group is a real estate investment trust, which holds and leases agricultural property and. Home RFF • ASX. add. Share. Rural Funds Group. $ Aug 16, PM GMT+10 ASX. Market news. tomyknees.site 4 hours ago. Asian Equities Rally as US. Comprehensive and up-to-date Rural Funds Group (ASX:RFF) stock information, news and insights by GuruFocus. RFA portion · Adjusted NAV is compiled on the basis of total assets to recognise water entitlements at fair value. · RFF is a stapled security, incorporating. Rural Funds (ASX:RFF) share price rises on FY23 result, despite higher interest rates. The Rural Funds Group (ASX:RFF) share price has risen as the market.

What To Look For When Day Trading

While the regulators likely intended to make this a deterrent by showing how hard trading is, it actually makes it look much easier than it is! 30% of traders. It is quite common for day traders to buy and sell the same security a number of times a day. They base their decisions on knowledge of the market and current. When buying as a day trader, look to exit near the top of the range but not right at the top. When shorting, look to exit in the lower portion of the range. Shorter time frames tend to be more volatile and can result in larger price swings, which can be riskier. If you are a risk-averse trader, consider using a. 1. Scan at Night · 2. Wake Up Early and Check Pre-Market Data · 3. Keep your Watch Lists Short · 4. Use Multiple Watch Lists · 5. Limit Your. Day traders rapidly buy, sell and short-sell stocks throughout the day in the hope that the stocks continue climbing or falling in value for the seconds or. Real-time market data and news Access to real-time market information is essential for day trading. Real-time market data and news allow traders to grasp the. Be sure to look for safety and reliability as well and always make sure you trade with a regulated broker. For example, the Admirals Group have entities. A lot can happen during the market day that can result in market and stock volatility that can be a challenge for even the most experienced day trader. It can. While the regulators likely intended to make this a deterrent by showing how hard trading is, it actually makes it look much easier than it is! 30% of traders. It is quite common for day traders to buy and sell the same security a number of times a day. They base their decisions on knowledge of the market and current. When buying as a day trader, look to exit near the top of the range but not right at the top. When shorting, look to exit in the lower portion of the range. Shorter time frames tend to be more volatile and can result in larger price swings, which can be riskier. If you are a risk-averse trader, consider using a. 1. Scan at Night · 2. Wake Up Early and Check Pre-Market Data · 3. Keep your Watch Lists Short · 4. Use Multiple Watch Lists · 5. Limit Your. Day traders rapidly buy, sell and short-sell stocks throughout the day in the hope that the stocks continue climbing or falling in value for the seconds or. Real-time market data and news Access to real-time market information is essential for day trading. Real-time market data and news allow traders to grasp the. Be sure to look for safety and reliability as well and always make sure you trade with a regulated broker. For example, the Admirals Group have entities. A lot can happen during the market day that can result in market and stock volatility that can be a challenge for even the most experienced day trader. It can.

Day traders generally strive for a keen awareness of events capable of triggering short-term fluctuations in the market. They often rely on news-based trading. However, day traders can increase their chances of success by identifying stocks that exhibit certain characteristics that will help drive a stock price higher. There are a few key factors to consider before you start to day trade any market, as the practice can require a lot more time than the typical buy and hold. Identify significant gaps on their preferred timeframe (often focusing on minute and 1-hour charts for day trading). Look for price to approach the FVG from. In order to become a consistently profitable trader you need to be trading the best day trading stocks for that day. Find out what to look for in this blog! What are some characteristics of stocks that day traders may look for? · Volatility · Liquidity and volume · Technical analysis set-ups · Reporting earnings. Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell. There are types of orders that day traders quickly become familiar with. A limit order is when an investor sets the price at which they'd like to buy or sell a. Many day traders employ technical analysis to generate signals of favorable trading probabilities. Others rely primarily on fundamental analysis and look to. There are two main things to look for when day trading stocks: liquidity and volatility. Liquidity is essential for day trading because you need to be able to. It's possible that day traders may look to execute multiple trades on the same asset on the same day. The key for day traders is to find beneficial entry and. Day trading might seem like a fast-paced and exciting way to make money, but the truth is more mundane. Day trading is a grind, requiring participants to. Day trading isn't as easy or lucrative as it might seem from the outside. Despite the challenges involved, some people elect to day trade as a part-time job or. However, day traders can increase their chances of success by identifying stocks that exhibit certain characteristics that will help drive a stock price higher. Many day traders employ technical analysis to generate signals of favorable trading probabilities. Others rely primarily on fundamental analysis and look to. Day trading works, ordinarily, by capitalizing on small market movements. Rapid market fluctuations, when the level of volatility is high, present more. A day trader is a stockbroker who focuses on buying and selling stocks to capitalize on market gains at the end of the day on behalf of customers. Volume tends to pick back up at the end of the day, as institutional investors look to close out positions or enter new ones. Higher volume is generally good. Before embarking on your day trading journey, it's crucial to develop a comprehensive understanding of the markets you intend to trade. This includes studying. Day trading guide for beginners · 1. Learn the basics of the stock market · 2. Choose a broker · 3. Set up a demo account · 4. Develop a trading strategy · 5. Start.

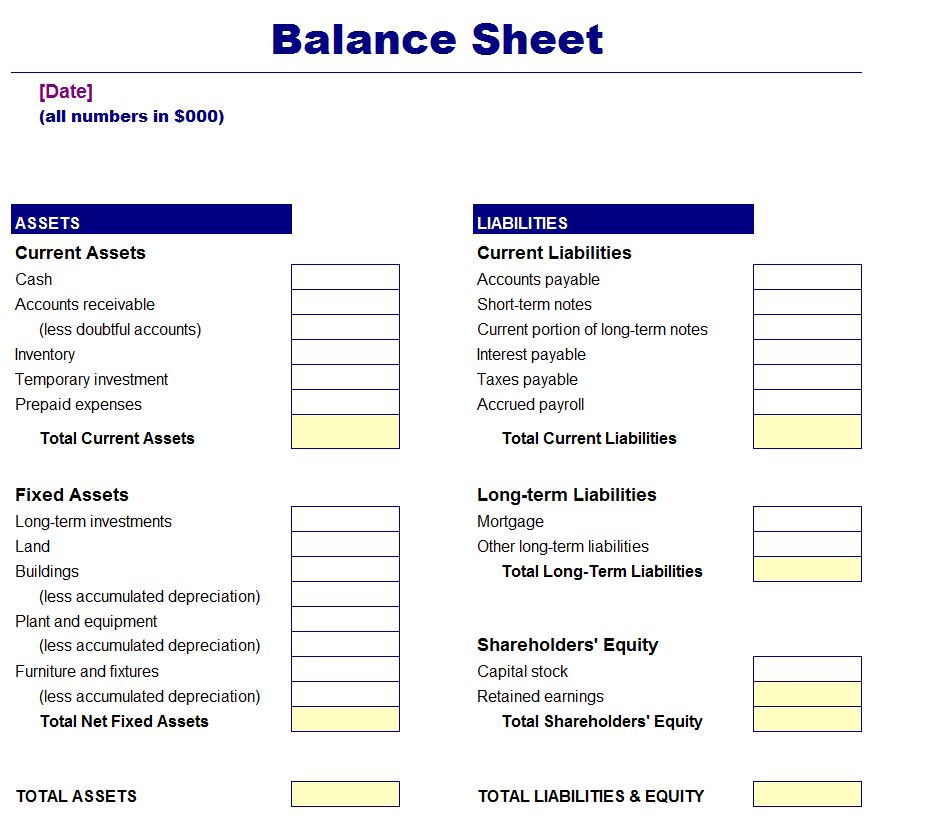

A Simple Balance Sheet

A balance sheet is one of the fundamental documents that make up a company's financial statements, along with the income statement, the cash flow statement. There are three different financial categories that make up a balance sheet—assets, liabilities and owner's (shareholder's) equity. As a small business startup. The balance sheet includes three components: assets, liabilities, and equity. It's divided into two sides — assets are on the left side, and total liabilities. Making a balance sheet takes 6 steps: (1) select a date, (2) prepare other docs, list (3) assets and (4) liabilities, (5) calculate SE, and (6) balance. A balance sheet is divided into two sides. It shows the assets on the left side and liabilities and equity on the right side. As the name suggests, both sides. A balance sheet is a key financial statement that represents a company's financial status at any given point in time, capturing the company's assets. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Breakdown of a balance sheet including total assets, total liabilities. Explore how a well-organized balance sheet can help your business avoid accounting errors, uncover new cash flow opportunities and achieve greater financial. Free sample balance sheet in accounting. Follow these six easy steps to learn balance sheet basics, how a balance sheet is made up, and how to read one. A balance sheet is one of the fundamental documents that make up a company's financial statements, along with the income statement, the cash flow statement. There are three different financial categories that make up a balance sheet—assets, liabilities and owner's (shareholder's) equity. As a small business startup. The balance sheet includes three components: assets, liabilities, and equity. It's divided into two sides — assets are on the left side, and total liabilities. Making a balance sheet takes 6 steps: (1) select a date, (2) prepare other docs, list (3) assets and (4) liabilities, (5) calculate SE, and (6) balance. A balance sheet is divided into two sides. It shows the assets on the left side and liabilities and equity on the right side. As the name suggests, both sides. A balance sheet is a key financial statement that represents a company's financial status at any given point in time, capturing the company's assets. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Breakdown of a balance sheet including total assets, total liabilities. Explore how a well-organized balance sheet can help your business avoid accounting errors, uncover new cash flow opportunities and achieve greater financial. Free sample balance sheet in accounting. Follow these six easy steps to learn balance sheet basics, how a balance sheet is made up, and how to read one.

A company's balance sheet, also known as a "statement of financial position," reveals the firm's assets, liabilities, and owners' equity (net worth) at a. This financial statement details your assets, liabilities and equity, as of a particular date. Although a balance sheet can coincide with any date, it is. Here is a balance sheet from Apple, for example. You'll see that it includes a complex stockholder's equity section and several specifically itemized types of. owner's equity – the amount left after liabilities are deducted from assets. Example of a balance sheet. ASSETS. Current Assets. Cash, $. The balance sheet shows the financial position of a company at a given point in time, and the income statement and cash flow statement show the economic. Understand a company's financial health with this balance sheet overview. Learn about assets, liabilities, equity and the accounting equation. Need a snapshot of your business's financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet. The balance sheet is essentially a financial statement that captures all assets and liabilities of an organization at a specific point in time. Your balance. There are three common financial statements for all companies. They are the balance sheet, the income statement, and the cash flow statement. The entire point. The balance sheet provides information on a company's resources (assets) and its sources of capital (equity and liabilities/debt). 1. Your Financial Statement Account titles may differ. 2. Your chart of accounts will likely differ in the chronological order of accounts. Account. Simple Balance Sheets. Accounting Equation is: Capital = Assets. This equation shows the owners investment into the business because capital is anything the. Balance sheets are considered the most important financial statement for any business. Do you know how to make one? Find out how using our guide! A balance sheet is one of the fundamental documents that make up a company's financial statements, along with the income statement, the cash flow statement. an easy-to-digest format. The structure of a balance sheet is built around a basic financial accounting equation: assets – liabilities = owner's equity. Maintaining a detailed balance sheet is important to keeping track of accurate accounting—of your company's assets, liabilities and equity. A balance sheet is a statement or summary of a company's finances, specifically its assets, liabilities, and shareholders' equity. How to Create a Simple Balance Sheet? · Step 1: Company Name · Step 2: Assets · Step 3: Liabilities · Step 4: Equity. You. We'll generate an Excel Balance Sheet after only a week to show this activity. To account for the fees/office supplies, do I need to debit our. A small business requires a balance sheet to get insight into its financial statement and overall value. It helps the owner keep track of the company's.

What Is A Carry Trade

What is a Carry Trade? A carry trade involves borrowing or selling a financial instrument with a low interest rate, then using it to purchase a financial. The basic idea of the carry trade, borrow money from a country where the interest rate is near zero, invest in safe bonds in higher interest rate countries. Carry Trade. For the bond market, this refers to a trade where you borrow and pay interest in order to buy something else that has higher interest. Trading Term · A trading strategy where the investor borrows money at a low interest rate to invest in higher yield assets. · In the forex market, a currency. In finance, carry typically refers to currency trades in which money is borrowed in a currency with low interest rates and invested somewhere else that has. Carry trades are long-term investments that need careful money management and pips are the currency pair's unit of measurement. When you have too much leverage. During the period of relatively low volatility in exchange rates from to , carry trades were highly profitable, with exchange rate movements between. The investment horizon for a carry trade is typically rather short in order to minimise the exposure to currency risk, thus requiring a systematic rollover. Carry trades are not usually arbitrages: pure arbitrages make money no matter what; carry trades make money only if nothing changes against the carry's favor. What is a Carry Trade? A carry trade involves borrowing or selling a financial instrument with a low interest rate, then using it to purchase a financial. The basic idea of the carry trade, borrow money from a country where the interest rate is near zero, invest in safe bonds in higher interest rate countries. Carry Trade. For the bond market, this refers to a trade where you borrow and pay interest in order to buy something else that has higher interest. Trading Term · A trading strategy where the investor borrows money at a low interest rate to invest in higher yield assets. · In the forex market, a currency. In finance, carry typically refers to currency trades in which money is borrowed in a currency with low interest rates and invested somewhere else that has. Carry trades are long-term investments that need careful money management and pips are the currency pair's unit of measurement. When you have too much leverage. During the period of relatively low volatility in exchange rates from to , carry trades were highly profitable, with exchange rate movements between. The investment horizon for a carry trade is typically rather short in order to minimise the exposure to currency risk, thus requiring a systematic rollover. Carry trades are not usually arbitrages: pure arbitrages make money no matter what; carry trades make money only if nothing changes against the carry's favor.

A carry trade involves borrowing from a lower interest rate asset, which is usually a currency pair, to fund the purchase of a higher interest rate asset. A typical carry trade hedge is an options strategy called a risk reversal; buy a yen call and finance this by selling a yen put. This will profit if the yen. Carry Trading Strategy Carry trading is a popular FX trading strategy that involves taking advantage of the interest rate differential between two currencies. A carry trade involves buying higher-yielding currencies by borrowing funds in lower-yielding currencies. In practice, that means buying those with high. The currency carry trade is defined by investing in a high-yielding currency, funded from a lower-yield currency. This carry trade is profitable as long as. A currency carry trade is a strategy that involves using a high-yielding currency to fund a transaction with a low-yielding currency. Lesson summary · Currency carry trades present traders with two avenues to profit (exchange rate and interest rate differential). · The essence of carry trade. A carry trade is a strategy that involves borrowing at a low-interest rate and investing in an asset that provides a higher rate of return. A carry strategy would be LONG Japanese. 10Y Bond Futures. Data Source: Bloomberg. Exhibit B: Fixed Income Carry Trade Example – Japanese 10Y Government Bonds. A carry trade using the dollar as the funding currency and the Asian and Latin American investments as the target. By the mid's a reversal happened and. Summary · FX carry trade, also known as currency carry trade, is a financial strategy whereby the currency with the higher interest rate is used to fund trade. A carry trade is one where a trader borrows one currency (for instance the USD), using it to buy another currency (such as the JPY). Carry trade is a strategy for making a profit on the foreign exchange market due to the interest rate difference of different countries, on whose currencies the. To measure the returns to the carry trade, I consider trades conducted on a currency by currency basis against the U.S. dollar. I also consider portfolio based. A carry trade is a strategy that involves borrowing at a low-interest rate and investing in an asset that provides a higher rate of return. Carry Trade · Carry trades in foreign exchange involves the borrowing of a low-interest bearing currency and investing in a higher-yielding currency. · The. Trading Term · A trading strategy where the investor borrows money at a low interest rate to invest in higher yield assets. · In the forex market, a currency. Learn how to apply 'Carry trade' – a trading technique in which a trader sells a currency with a low-interest rate and then uses it to purchase another. The idea of the carry trade strategy is really simple, strategy systematically sells low-interest-rates currencies and buys high-interest rates currencies. We show in the cross section and in the time series that high interest rate differentials predict negative skewness, that is, carry trade returns have crash.

Ko Stock Forecast 2025

Coca-Cola Consolidated Stock Prediction The Coca-Cola Consolidated stock prediction for is currently $ 1,, assuming that Coca-Cola. Coca-Cola Estimates* in USD ; EPS (GAAP), , ; Gross Income, 28,, 29, ; Cash Flow from Investing, -8,, -9, ; Cash Flow from Operations, 10, The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. Coca-Cola (NYSE:KO) Stock, Analyst Ratings, Price Targets, Forecasts Coca-Cola Co has a consensus price target of $ based on the ratings of 22 analysts. Quarterly Earnings Forecast ; Fiscal Quarter End. Consensus EPS* Forecast. High EPS* Forecast ; Sep ; Dec ; Mar stock price prediction is 0 USD. The stock forecast is 0 USD for August 28, Thursday with technical analysis About the Coca-Cola Consolidated Inc stock. Coca-Cola stock prediction for March The forecast for beginning dollars. Maximum price , minimum Averaged Coca-Cola stock price for the. The future outlook for Coca-Cola's stock appears promising, with projections indicating steady growth and value appreciation over the coming decades. The Coca-Cola (KO) stock price prediction is USD. The The Coca-Cola stock forecast is USD for August 31, Sunday;. Coca-Cola Consolidated Stock Prediction The Coca-Cola Consolidated stock prediction for is currently $ 1,, assuming that Coca-Cola. Coca-Cola Estimates* in USD ; EPS (GAAP), , ; Gross Income, 28,, 29, ; Cash Flow from Investing, -8,, -9, ; Cash Flow from Operations, 10, The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. Coca-Cola (NYSE:KO) Stock, Analyst Ratings, Price Targets, Forecasts Coca-Cola Co has a consensus price target of $ based on the ratings of 22 analysts. Quarterly Earnings Forecast ; Fiscal Quarter End. Consensus EPS* Forecast. High EPS* Forecast ; Sep ; Dec ; Mar stock price prediction is 0 USD. The stock forecast is 0 USD for August 28, Thursday with technical analysis About the Coca-Cola Consolidated Inc stock. Coca-Cola stock prediction for March The forecast for beginning dollars. Maximum price , minimum Averaged Coca-Cola stock price for the. The future outlook for Coca-Cola's stock appears promising, with projections indicating steady growth and value appreciation over the coming decades. The Coca-Cola (KO) stock price prediction is USD. The The Coca-Cola stock forecast is USD for August 31, Sunday;.

Analyst Estimates: More Content: Snapshot, Stock Price Targets, Yearly Numbers, KO will report earnings on 02/18/ The Coca-Cola Company Stock Price Forecast, "KO" Predictons for The Coca-Cola Company Stock Forecast and Price Prognosis Data for Find the latest KO Jun call (KOC) stock quote Coca-Cola (KO). Coca-Cola Consolidated Stock Price History. Is COKE stock going to rise? The current trend is moderately bullish and COKE is experiencing slight selling. View Coca-Cola Company KO stock quote prices, financial information, real-time forecasts, and company news from CNN. Get The Coca Cola real-time stock quotes, news, price and financial information from Macroaxis. Analyze Coca Cola Stock Investing. Coca-Cola Co. analyst ratings, historical stock prices, earnings estimates & actuals. KO updated stock price target summary KO will report FY View Coca-Cola Company KO stock quote prices, financial information, real-time forecasts, and company news from CNN. , $, %, $, $, Dec. , $, %, $, $, 13 Stock Market Holidays & Hours · After Hours Trading · Portfolio Management. Get Coca-Cola Co (KO:NYSE) real-time stock quotes, news, price and financial information from CNBC. Coca-Cola stock prediction for March In the beginning at Maximum , minimum The averaged price At the end of the month The average target predicts a decrease of % from the current stock price of On average, 9 Wall Street analysts forecast KO's earnings for to be $13,,,, with the lowest KO earnings forecast at $12,,,, and the. The average one-year price target for The Coca-Cola Company is $ The forecasts range from a low of $ to a high of $ A stock's price target is. Coca Cola Co Stock (KO) Price Forecast for Our forecast for KO stock price in now indicates an average price target of $ with a high forecast of. Stock Price Forecast The 15 analysts with month price forecasts for KO stock have an average target of , with a low estimate of 64 and a high estimate. Based on the our new experimental Coca-Cola price prediction simulation, tomyknees.site's value in expected to grow by %% to $1, if the best happened. What Is the KO Stock Forecast for ? With an AI score of 49, the KO stock forecast suggests stability. What is the KO price prediction for ? To. See The Coca-Cola Company (KO) stock analyst estimates, including earnings and revenue, EPS, upgrades and downgrades Next Year (). No. of Analysts. Earnings and Revenue Growth Forecasts ; 12/30/, 50,, 13,, 12,, 15, ; 12/30/, 48,, 12,, 11,, 14,